Corporate Governance

Basic Strategies for Corporate Governance

The main purpose of our management system is to respond quickly and accurately to changes in our business climate and to maintain fair business operations. Achieving stable growth in shareholder value is another top priority of management. To maintain positive relations with our stakeholders, including shareholders, business partners, members of regional communities, and employees, we are endeavoring to expand and improve our corporate governance. We acknowledge the importance of establishing an internal control system that provides stakeholders with important information in a timely manner and of reinforcing corporate governance throughout the Group. Based on that recognition, we plan to establish administrative rules for Group companies and a reporting structure to maintain fair business practices and share information.

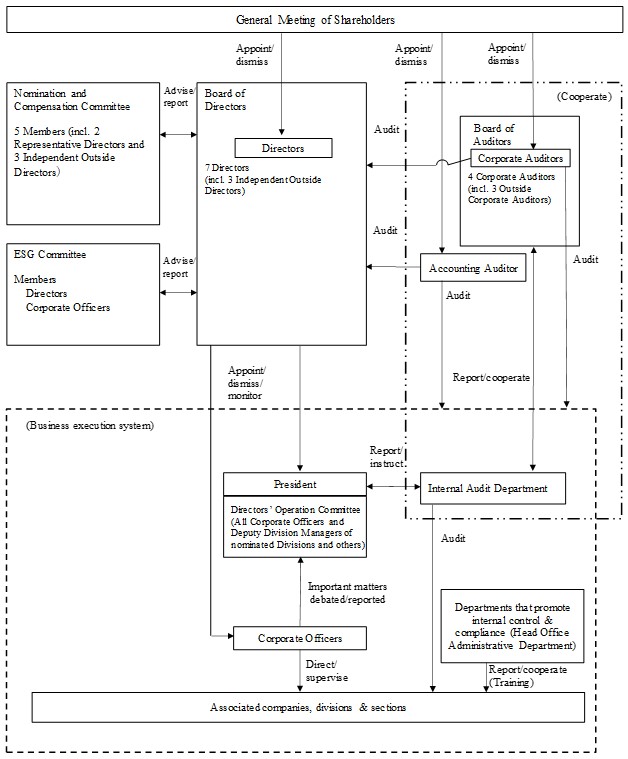

Corporate Governance Structure

Basic Policy on Internal Control

Based on the Companies Act and the Ordinance for Enforcement of the Companies Act, the Company shall establish a “system to secure appropriateness of operations” (internal control) as follows.

1. System to Ensure that the Execution of Duties by Directors and Employees Conforms to Laws and Regulations and the Articles of Incorporation

- The ISEKI Group Code of Ethical Behavior and the Ethical Code shall be the basis of the compliance system and shall be thoroughly disseminated to all members of the Group through means such as education and training.

- The Company shall operate the Group Internal Communications System (Ethical Hotline), which was established as a reporting system related to compliance, based on the internal communications system management regulations.

- The officer in charge of compliance shall supervise and manage compliance, and the compliance working group related to ESG promotion shall play a central role in ensuring thorough compliance. In addition, the situation shall be reported to and discussed with the ESG Committee, whose meetings are attended by all Directors and Corporate Officers.

- The Internal Audit Department audits the status of compliance implementation and reports the results of audits to and discusses with the Board of Directors, the President, Outside Directors, and Corporate Auditors.

- Directors and employees shall immediately report to the Board of Directors, the President, Outside Directors, and Corporate Auditors if they discover any serious violations of laws and regulations. The details shall also be reported to and discussed with the ESG Committee.

- The Company shall work against any possibility of a relationship with anti-social forces or groups based on the guidelines set forth in the ISEKI Group Code of Ethical Behavior. Moreover, in order to eliminate anti-social forces, the Company shall establish systems and conduct activities based on the Regulations for Responding to Anti-Social Forces.

2.System to Store and Manage Information Related to the Execution of Duties by Directors

- Information related to the execution of duties by Directors, such as minutes of meetings of the Board of Directors and approval documents, shall be stored and managed appropriately according to the nature (confidentiality and importance) of the information, in accordance with the Board of Directors Regulations and the Document Regulations. Moreover, information shall be stored and managed appropriately and reliably in a highly retrievable state according to the storage medium.

- In order to appropriately maintain and manage information assets, the Company shall establish and operate an information security management system based on the Electronic Information Security Management Regulations.

- Personal information shall be appropriately stored and managed based on laws, regulations, and the Personal Information Handling Regulations.

3. Regulations and Other Systems Concerning the Management of Risk of Loss

- The Company shall conduct comprehensive risk management in accordance with the risk management regulations, with the Corporate Planning Department as the department in charge. This department shall identify and evaluate risks surrounding the Group and take appropriate countermeasures.

- Directors and employees shall immediately report to the Board of Directors, the President, Outside Directors, and Corporate Auditors if they become aware of any serious risks.

- The Company shall establish a business continuity plan in anticipation of a large-scale disaster or other occurrence, and in the case of an unforeseen event, we shall set up a task force headed by the President as well as subordinate organizations in accordance with the pan to take prompt action and minimize damage and impact.

4. System to Ensure the Efficient Execution of Duties by Directors

- The Board of Directors shall ensure the efficient execution of duties by Directors through the establishment of regulations such as the Authority Regulations and the regulations on the division of duties, a budget system, and a personnel-management system.

- The Board of Directors shall engage in multi-faceted consideration of important matters concerning the execution of duties by Directors.

- In order to enhance and expedite decision-making by the Board of Directors, and to strengthen business execution and supervisory functions, the President shall hold regular meetings with Outside Directors to exchange information and opinions.

5.System to Secure Appropriateness of Operations in the Corporate Group Consisting of the Company and its Subsidiaries

- In order to ensure the appropriateness and efficiency of operations related to all Group companies, the Company shall have each Group company establish various regulations and strive to strengthen the cooperation system, based on the affiliated company control regulations. With respect to business management, the Company shall manage the business of Group companies through approval of important management matters as well as regular reports and discussions on the business execution status and financial status, in accordance with the affiliated company control regulations.

- The Company requires Directors of major subsidiaries to make regular reports to the Board of Directors, etc. on their business execution status.

- When a risk is identified or a compliance violation occurs, Group companies shall immediately notify the department in charge of operations, and the department shall take appropriate action.

- In order to ensure the appropriateness and reliability of financial reporting, the Company shall establish systems, evaluate their effectiveness, and make improvements based on the Financial Instruments and Exchange Act and other applicable laws and regulations.

- In order to ensure the appropriateness of operations, the Company and its major subsidiaries shall establish a system in which the administrative departments of both the Company and the relevant subsidiary shall cooperate to monitor the business department and take appropriate measures.

- The Internal Audit Department regularly and irregularly conducts internal control audits, and reports important matters to and discusses with the Board of Directors, the President, Outside Directors, and Corporate Auditors.

- In the event that a Group company recognizes that the content of business management, management guidance, etc. from the Company violates laws and regulations, or that there are any other compliance problems, the Group company shall report this to the department in charge of operations or Corporate Auditors, or to the ESG Committee.

- Regarding serious violations of laws and regulations, the department in charge of operations shall immediately report to the Board of Directors, the President, Outside Directors, and Corporate Auditors. The details shall also be reported to and discussed with the ESG Committee.

6.Matters Related to Employees to Assist Corporate Auditors in Their Duties When Such Employees Are Requested by Corporate Auditors, Matters Related to the Independence of Such Employees from Directors, and Matters Related to Ensuring the Effectiveness of Instructions Given by Corporate Auditors to Employees

- If a request is made by Corporate Auditors, employees to assist Corporate Auditors in their duties shall be assigned.

- Matters pertaining to the appointment, transfer, reprimand, evaluation, etc. of such employees shall be decided upon obtaining the consent of the Board of Auditors.

- Such employees shall be exclusively assigned to the Corporate Auditors and shall not concurrently serve in other departments.

7. System for Reporting to Corporate Auditors and System to Ensure That Persons Who Reported to Corporate Auditors Will Not Receive Unfavorable Treatment on the Ground of Such Reports

- Directors, the Internal Audit Department, and other employees of the Company, as well as Directors and employees of subsidiaries, or those who have received reports from these persons (hereinafter collectively referred to as “Directors and employees, etc.”) shall immediately report to the Company’s Corporate Auditors if they become aware of any serious violations of laws and regulations or any serious risks.

- Directors and employees, etc. shall report to the Company’s Corporate Auditors on important matters concerning the business or performance of the Company and its Group companies, as appropriate.

- Corporate Auditors may request reports from Directors and employees, etc., whenever necessary.

- Directors and employees, etc. shall not be treated unfavorably on the grounds that they made the above reports.

8.Matters Related to the Treatment of Costs and Liabilities Arising from the Execution of Duties by Corporate Auditors

Costs and liabilities arising from the execution of duties by Corporate Auditors shall be paid in advance or settled without delay upon request from the Corporate Auditors.

9.Other Systems to Ensure the Effective Execution of Audits by Corporate Auditors

- The President shall have opportunities to have an interview with Corporate Auditors on a regular basis, and exchange information and opinions regarding issues that the Company should address and important audit issues.

- Corporate Auditors shall hold regular meetings with the accounting auditor and the Internal Audit Department to receive audit status reports and exchange opinions, and in doing so create an environment that enables close cooperation.

- In addition to attending meetings of the Board of Directors, Corporate Auditors may attend and express opinions at meetings such as ESG Committee meetings, and view minutes of meetings and other related documents, in order to understand the process of important decision-making and the status of execution of duties.

- If a Corporate Auditor recognizes that there is a problem with the operation of the Group’s compliance system or internal reporting system, they may express their opinion to the Directors, the officer in charge, or the department in charge of operations and request the formulation of improvement measures.

Enacted on May 12, 2006

Revised on June 21, 2007

Revised on December 26, 2008

Revised on March 28, 2013

Revised on May 28, 2015

Revised on October 1, 2020

Revised on August 10, 2022

Revised on November 30, 2022

Revised on July 1, 2023

Revised on December 27, 2024